When it comes to earning a living, understanding how your income is taxed and what deductions are taken from your paycheck is crucial. In this article, we’ll explore the statutory deductions applied to employee wages in several countries as compared to the Philippines.

PHILIPPINES

- PhilHealth Contribution[1]:

- Rate: 5% of the monthly basic salary, shared between the employer and employee

- PhilHealth Premium Contribution Schedule

- Social Security System (SSS) Contribution[2]:

- Contribution rate varies based on the monthly salary credit, shared between the employer and employee.

- SSS Employer and Employee table

- Pag-IBIG Fund Contribution[3]:

- Rate: 2% to 4% of the monthly basic salary, shared between the employer and employee.

- Pag-IBIG Contribution Table 2024 – Latest Payment Schedule (pagibiginquiries.online)

- Withholding Tax on Compensation[4]:

- Rate: Progressive tax rates ranging from 0% to 35%.

- BIR – Witholding Tax Calculator

UNITED STATES OF AMERICA

- Federal Income Tax[5]:

- Description: Federal income tax is deducted from employees’ paychecks based on their income, tax filing status, and allowances claimed on Form W-4.

- Rate:

| 2023 Rate | Single Individual | Head of Household | Married Joint Return | Married Separate Return |

| 10% | $0 to $11,000 | $0 to $15,700. | $0 to $22,000. | $0 to $11,000. |

| 12% | $11,001 to $44,725 | $15,701 to $59,850. | $22,001 to $89,450 | $11,001 to $44,725. |

| 22% | $44,726 to $95,375 | $59,851 to $95,350 | $89,451 to $190,750 | $44,726 to $95,375. |

| 24% | $95,736 to $182,100 | $95,351 to $182,100 | $190,751 to $364,200 | $95,376 to $182,100. |

| 32% | $182,101 to $231,250 | $182,101 to $231,250. | $364,201 to $462,500 | $182,101 to $231,250. |

| 35% | $231,251 to 578,125 | $231,251 to $578,100. | $462,501 to $693,750. | $231,251 to $346,875. |

| 37% | 578,126 or more | $578,101 or more. | $693,751 or more | $346,876 or more. |

- Social Security Tax (FICA – Federal Insurance Contributions Act):[6]

- Rate: 6.2% for the employee plus 6.2% for the employer

- Payroll Tax Calculator -Social Security and Medicare Contributions and Wage Limits – 2000 through 2023 (moneychimp.com)

- Medicare Tax[7]:

- Rate: 1.45% for the employee plus 1.45% for the employer

- Payroll Tax Calculator -Social Security and Medicare Contributions and Wage Limits – 2000 through 2023 (moneychimp.com)

- Additional Medicare Tax (for higher earners):[8]

- Rate: 0.9% for the employee when wages exceed $200,000 in a year:

- Federal Unemployment Tax (FUTA):[9]

- Description: The FUTA tax is not directly deducted from employee paychecks. Instead, it is paid by employers to fund unemployment benefits for workers who have lost their jobs. Employers are responsible for paying this tax and do not typically pass it on to employees.

- Rate: 6% for the employer on the first $7,000 paid to the employee.

- Payroll Tax Calculator for Employers | Gusto

- State Income Tax[10]:

- Description: Some states impose a state income tax on employees’ wages. The rates and income brackets vary by state.

- Local Taxes[11]:

- Description: In certain cities or counties, additional local taxes may be imposed on employees’ wages. The rates and rules vary depending on the local jurisdiction.

CANADA

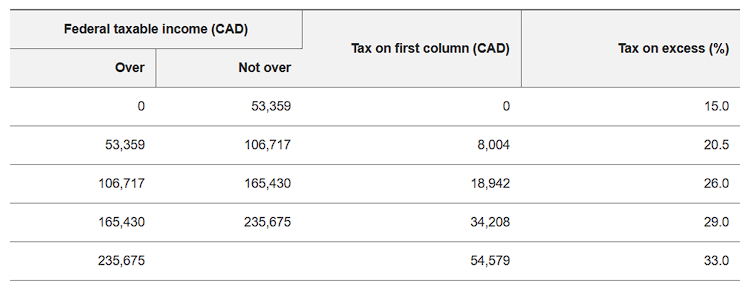

- Income Tax[12]:

- Description: Federal and provincial/territorial income taxes are deducted from an employee’s wages based on their income and the applicable tax rates. The amount of income tax withheld depends on the employee’s tax bracket and the information provided on their TD1 form.

- Rate:

- 2023 Personal tax calculator | EY Canada (eytaxcalculators.com)

- Canada Pension Plan (CPP) Contributions[13]:

- Description: CPP contributions are deducted from an employee’s wages to fund the Canada Pension Plan, which provides retirement, disability, and survivor benefits. The contribution rates are based on a percentage of the employee’s pensionable earnings, up to a maximum annual pensionable earnings limit set by the CRA.

- As of 2023, The CPP contribution rate is at 5.95% for employers and employees, and at 11.9% for people who are self-employed, unless their earnings rise higher than the earnings ceiling.

- CPP calculator, Canada Pension Plan 2023 (calculconversion.com)

- Employment Insurance (EI) Premiums[14]:

- Description: EI premiums are deducted from an employee’s wages to fund the Employment Insurance program, which provides temporary income support for individuals who are unemployed or on parental leave. The contribution rates are based on a percentage of the employee’s insurable earnings, up to a maximum annual insurable earnings limit set by the CRA.

- Rate: As of 2023, $1.63 per $100.

- Employment insurance premium calculator for Canada in 2023 (calculconversion.com)

- Quebec Pension Plan (QPP) Contributions (for employees in Quebec)[15]:

- Description: Employees in Quebec contribute to the Quebec Pension Plan, which provides retirement, disability, and survivor benefits in the province. The contribution rates are similar to the CPP rates but may differ slightly.

- Rate: As of 2023, 6.40% of pensionable earnings for the year.

- Revenu Québec (revenuquebec.ca)

- Provincial Health Premiums (varies by province)[16]:

- Description: Some provinces levy health premiums or health taxes on employees’ wages to help fund healthcare services. The rates and rules vary by province.

SINGAPORE

- Central Provident Fund (CPF) Contributions:

- Rate: CPF contributions are based on contribution rates determined by age and wage level.

- Source: Central Provident Fund Board (CPF Board)

- Description: CPF contributions are made up of both the employee’s share and the employer’s share. The employee’s contribution rates vary based on the age group and wage band, and the employer contributes a matching amount. The contribution rates for Ordinary Wages (OW) and Additional Wages (AW) are as follows:

- CPFB | CPF contribution calculator

- Skills Development Levy (SDL)[17]:

- Description: The SDL is paid by employers on behalf of their employees and is used to support workforce development initiatives and training programs in Singapore.

- Rate: 0.25% of the employee’s gross monthly remuneration, subject to a monthly cap of $11.25 (for employees earning more than $4,500 per month)

- Accurate CPF Calculator for 2014-2023 | Talenox

.

- Personal Income Tax[18]:

- Description: Individual taxpayers are subject to personal income tax based on their chargeable income and tax residency status.

- Rate: Personal income tax rates are progressive, ranging from 0% to 22% for resident taxpayers).

- tax-calculator_residents_ya23.xls (live.com)

AUSTRALIA

- Superannuation Guarantee (SG) Contributions[19]:

- Source: Australian Taxation Office (ATO)

- Description: Employers are required to contribute a minimum of 10% of an employee’s OTE to their nominated superannuation fund. The Superannuation Guarantee is designed to help Australian workers save for their retirement.

- Rate: The Superannuation Guarantee rate is currently 11% (2023-2024) of an employee’s ordinary time earnings (OTE).

- Questions | Super guarantee contributions calculator

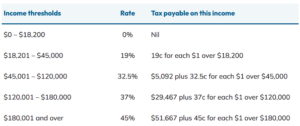

- Pay-As-You-Go (PAYG) Income Tax:

- Description: PAYG income tax is deducted from an employee’s wages by the employer and remitted to the Australian Taxation Office. The amount withheld depends on the employee’s income and the tax scales provided by the ATO.

- Rate: As of 2023-2024

- Questions | Tax withheld for individuals calculator

- Medicare Levy[20]:

- Description: The Medicare Levy helps fund Australia’s public healthcare system, known as Medicare. It is levied on Australian residents to support access to medical services.

- Rate: The Medicare Levy is currently 2% of an individual’s taxable income.

- Questions | Medicare levy calculator

- Medicare Levy Surcharge (if applicable)[21]:

- Description: The Medicare Levy Surcharge is intended to encourage individuals to take out private health insurance and reduce the demand on the public healthcare system.

- Rate: The Medicare Levy Surcharge rate varies based on income and family status. It is an additional amount payable by high-income earners who do not have private hospital cover.

JAPAN

- Employees’ Pension Insurance (Kosei Nenkin):

- Source: Japan Pension Service (JPS)

- Description: The Employees’ Pension Insurance system provides pension benefits to employees in Japan. The contribution is typically shared between the employer and the employee, with the employee’s portion withheld from their salary.

- Rate: The contribution rate for Employees’ Pension Insurance is 9.15% of an employee’s monthly earnings.

- Japan Salary Calculator 2023/24 (icalculator.com)

- Health Insurance (Kenko Hoken):

- Source: Local government (municipalities)

- Description: Health Insurance (on a maximum salary of 1,390,000 JPY per month). Each region has its own health insurance rate, and rates are slightly higher for individuals between the ages of 40 and 65.

- Rate: 4.92%

- Japan Salary Calculator 2023/24 (icalculator.com)

- Unemployment Insurance(Koyou Hoken)[22]:

- Description: also known as shitsugyou hoken— is a kind of safety net for those who have lost their job in Japan and are yet to find a new one. The scheme helps recently unemployed people to support themselves until they find their next job.

- Rate: 0.60%

- Income tax calculator 2023 – Japan – salary after tax (talent.com)

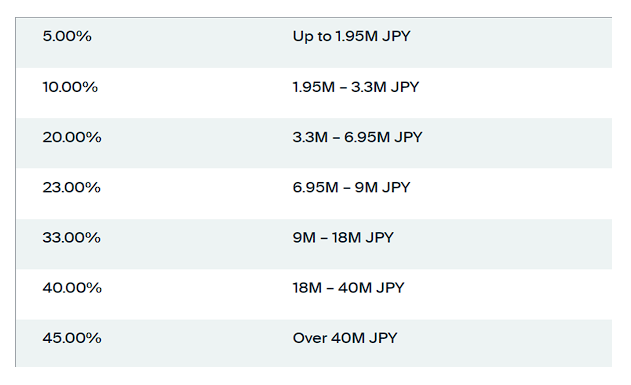

- Income Tax (Shotoku Zei)[23]:

- Description: Income tax is levied on an employee’s taxable income. The amount of income tax withheld from an employee’s salary depends on their annual income and the tax brackets set by the government.

- Rate:

- Japan Salary Calculator 2023/24 (icalculator.com)

SOUTH KOREA

- National Pension[24]:

- Description: The National Pension is a social insurance program in South Korea that provides retirement and other benefits to eligible individuals. Both employers and employees are required to contribute to the National Pension scheme.

- Rate: 9% of monthly salary up to KRW 5.53 million (the minimum payable is KRW 0.35 million) which is shared equally between the employer and the employee.

- Income tax calculator 2023 – South Korea – salary after tax (talent.com)

- Employment Insurance[25]:

- Description: Employment Insurance provides income support to employees who become unemployed involuntarily. It also offers various benefits, such as job training and job placement services.

- Rate: The employee contribution rate for EI is 0.90%. In addition to the 0.90% contributions to EI, employers are required to make 0.25%~0.85% contributions to employment stabilization insurance and occupational competency development insurance.

- Income tax calculator 2023 – South Korea – salary after tax (talent.com)

- Health Insurance[26]:

- Description: South Korea has a National Health Insurance program that provides health coverage to its citizens, including employees. The contributions help fund healthcare services and medical expenses.

- Rate: approximately 7.998% of the monthly wages; split equally between employers and employees at approximately 3.999% each

- Income tax calculator 2023 – South Korea – salary after tax (talent.com)

- Industrial Accident Compensation Insurance[27]:

- Description: Industrial Accident Compensation Insurance provides compensation and benefits to employees who suffer from work-related accidents or illnesses.

- Rate: 0.7% to 1.9% of the worker’s salary for work accident compensation insurance

- Income Tax[28]

- Rate:

NEW ZEALAND

- KiwiSaver Contributions[29]:

- Description: KiwiSaver is a voluntary retirement savings scheme in New Zealand. Employees who are enrolled in KiwiSaver have a portion of their salary or wages deducted and contributed to their KiwiSaver account, which is managed by a KiwiSaver provider.

- Rate: The default employee contribution rate is 3% of an employee’s before-tax salary or wages. Employees can choose to contribute at a higher rate (4%, 6%, 8%, or 10%) or opt-out of KiwiSaver.

- https://sorted.org.nz/tools/kiwisaver-calculator

- ACC (Accident Compensation) Levies[30]:

- Description: ACC provides comprehensive, no-fault personal injury cover for all New Zealand residents and visitors. The ACC levies are used to fund injury compensation and support services

- Rate: April 1, 2023 – April 1, 2024 = $1.53 per $100 (1.53%)

- Income tax calculator 2023 – New Zealand – salary after tax (talent.com)

- PAYE (Pay as You Earn) Income Tax[31]:

- Description: PAYE is a system used by employers to deduct income tax from employees’ wages and send it to Inland Revenue on their behalf. The amount of income tax withheld depends on the employee’s annual earnings and tax code.

- Rate:

- Income tax calculator 2023 – New Zealand – salary after tax (talent.com) .

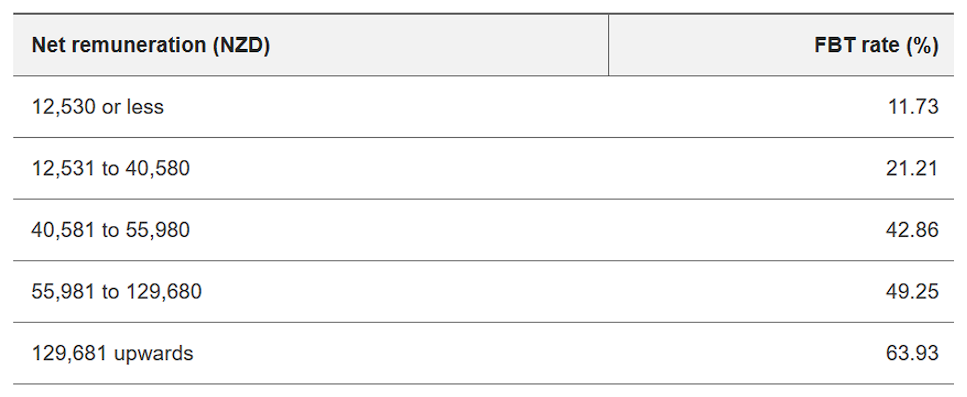

- Fringe Benefit Tax[32]

- Description: The Fringe Benefit Tax (FBT), which is payable by employers, is a tax on benefits that employees receive because of their employment, including those benefits provided through someone other than an employer.

- Rate:

Understanding statutory deductions is essential for both employees and employers. While the Philippines has a straightforward system of statutory deductions, it’s important to be aware of the differences when working or doing business in foreign countries. By understanding these differences, individuals can effectively manage their finances and comply with local laws and regulations.

[1] Philippine Health Insurance Corporation

[2] Social Security System

[3] Home Development Mutual Fund (HDMF or Pag-IBIG Fund)

[4] Bureau of Internal Revenue

[5] Internal Revenue Service (IRS)

[6] Social Security Administration

[7] Id.

[8] Id.

[9] Id.

[10] State tax authorities (varies by state)

[11] Local tax authorities

[12] Canada Revenue Agency

[13] Id.

[14] Id.

[15] Retraite Québec

[16] Provincial or territorial tax authorities (varies by province)

[17] SkillsFuture Singapore Agency (SSG)

[18] Inland Revenue Authority of Singapore (IRAS)

[19] Australian Taxation Office (ATO

[20] Id.

[21] Id.

[22] Ministry of Labor (Japan)

[23] National Tax Agency (NTA)

[24] National Pension Service (NPS)

[25] Korea Employment Information Service (KEIS)

[26] National Health Insurance Service (NHIS)

[27] Korea Workers’ Compensation & Welfare Service (COMWEL)

[28] National Tax Service (NTS) of South Korea

[29] Inland Revenue (New Zealand Government)

[30] Accident Compensation Corporation (ACC)

[31] Id.

[32] Id.